Music. I'm attorney Laura Anthony, founding partner of Legal & Compliance, a full-service corporate securities and business transactions law firm. Today is the last in a law class series, talking about form 8-k. Any company that is subject to the reporting requirements of the Securities Exchange Act of 1934 must file periodic reports on Form AK. I have been going through the events that trigger such form 8-k filing requirements. Session 6 relates to asset-backed securities. Item 6.01 reports asset-backed securities or ABS informational and computational materials. Item 6.02 reports the change of servicer or trustee. This item includes changes, whether it's your resignation or termination. Item 6.03 reports the change in credit enhancement or other external support and requires a report of any material changes, whether through the loss, additions, or change in support Item 6.04 reports the failure to make a required distribution. 6.04 only requires the report of a material failure to distribute in a timely manner. Item 6.05 reports Securities Act updating disclosures and includes material changes in an offering of AB securities. Item 6.06 reports a static pool and is used as an alternative to filing a prospective settlement required by item 1105 of regulation AB. Item 7 discusses regulation FD or fair disclosure. Item 7.1 reports regulation FD disclosures. Item 7.1.1 information should be furnished and not filed. We'll talk about that in a second where the information is material nonpublic information, such as in a press release. The filing must be made immediately prior to or simultaneously with the issuance of the release. Where information is accidentally released, such as in a press conference or discussion with a third party, the filing must be made immediately after the release of the information and on the same calendar day. Regulation FD disclosures are an exception to the...

Award-winning PDF software

Irs 870 pt Form: What You Should Know

In other words, each person in the consolidation group has to be listed on the Form 870-PT. Jun 20, 2024 — Guidance for Form 870-PT (AD), Settlement Agreement, For Partnership Items, to be Used by a Participating Business. 8.19.13 Settlement Agreement by a Party to a Rescission or Discharge of the Disposition or Reversal — IRS In e-mailed guidance, the IRS advises that an individual (sole proprietor) who has reached a settlement agreement with a nonresident alien partnership (Rescission) cannot disallow the partnership for which the individual participated in the plan and is a partner in a business in the same plan, and that such individual cannot participate in a res judicata action in respect of the partnership (Discharge). When a partnership disposes of an item which would have been an item in a plan or a separate return, the individual is liable to pay the business interest, capital gains, and ordinary income in respect of the share of the partnership's income, loss, deduction or credit in excess of the amount of any benefit which would have been paid or accrued in respect of the item if it had been held for the individual. 8.19.14 Settlement Agreement by a Party to a Rescission — IRS In e-mailed guidance, the IRS warns against using the settlement agreement in a res judicata action: In general, the individual's share of the partnership's loss will be reduced by a reasonable amount if the individual can show that he or she has exercised reasonable care in seeking to resolve the matter through the normal course of business. A claim for relief must include sufficient detail to show the amount of the reduction and the reasons why the reduction is reasonable. The individual's claim must be based on actual and reasonable procedures used in the case and not on a suggestion that the claim should be denied because the individual is a third-party beneficiary. 8.19.

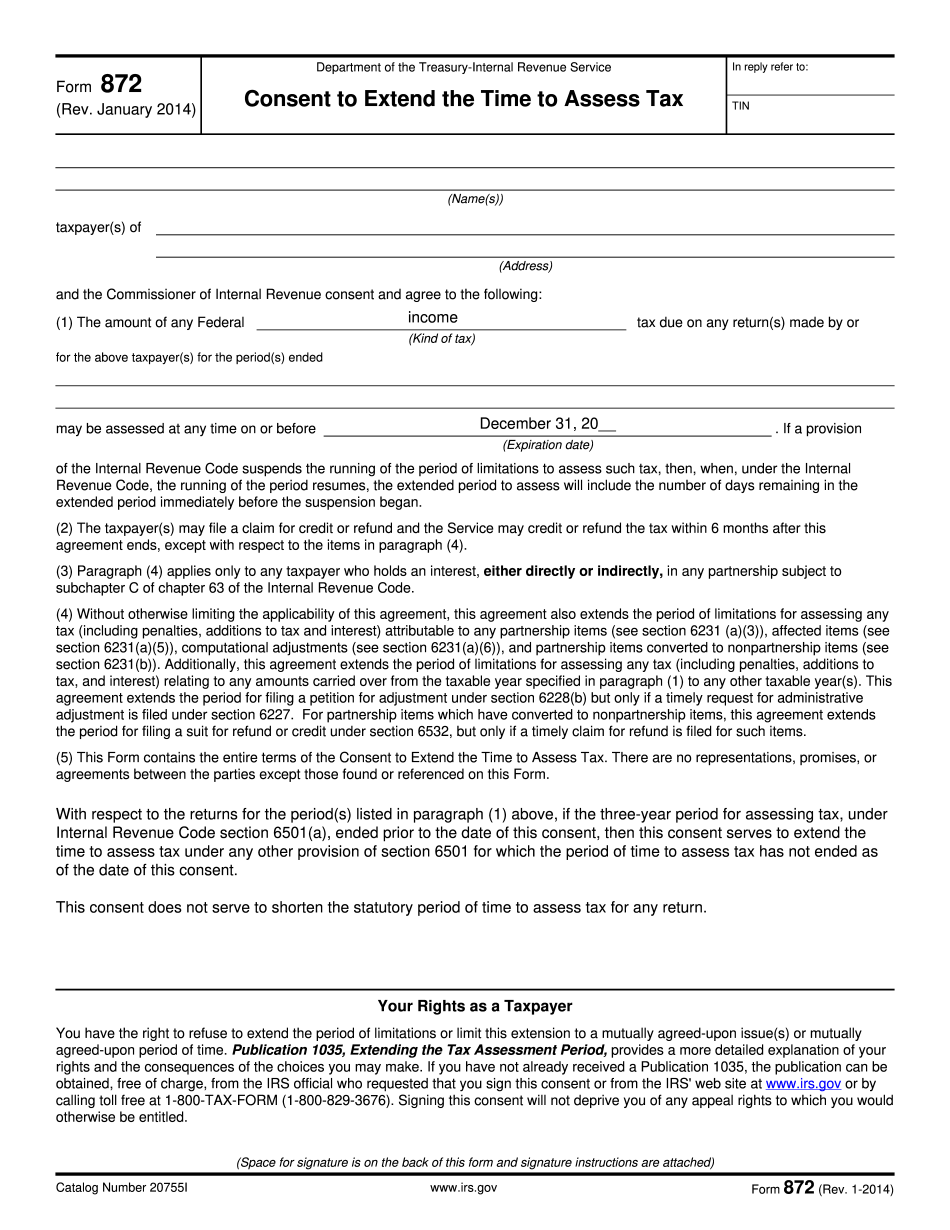

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 872, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 872 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 872 By using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 872 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs form 870 pt