Hello, I wanted to talk to you today about the complex. About 30 years ago, Congress introduced legislation intended to stop Americans from gaining a tax advantage by investing in non-US investment funds. But as we will see, the rules go further than that. So, what is a passive foreign investment company? Well, the first thing is that it's a foreign corporation, meaning a non-US corporation. Then, there is an income and an asset test. The income test states that if over 75 percent of your income comes from passive income, then you're going to be a passive or investment company. The asset test is that if over fifty percent of your assets are passive assets, then you'll be regarded as a passive foreign investment company. So, what is passive income? Well, passive income includes things like interest, dividends, and rents. Passive assets are assets like cash, bank accounts, stocks, bonds, land, and most rental assets. Now, there are a few exceptions to those, but they're fairly complex and technical. The intended victims of the passive foreign investment company legislation are foreign investment funds. If you invest in a non-US investment fund, mutual fund, investment company, or something similar, it's almost certainly going to be caught by the passive foreign investment company rules. Other kinds of companies can also get caught, especially startups that may have lots of assets but not much income or no income at all. However, there are exclusions that can cover those in some circumstances, as well as an exclusion for so-called controlled foreign corporations that may mean that they are not taxed as a passive foreign investment company. So, what's the effect of owning a passive foreign investment company? Congress has given you three options in terms of how they can be taxed. The first...

Award-winning PDF software

8886 fill in Form: What You Should Know

A taxpayer who participates in a deal or transaction that the IRS declares “unreportable” must file Form 8886 if it is intended for certain uses, such as remitting dividends on capital assets or selling securities. If a taxpayer does not file a Form 8886 Statement, and the IRS claims that the transaction would be tax-avoiding, the taxpayer can challenge the IRS claim as provided in the section below. Challenging IRS 'Unavoidable' Transaction Claims Before you file, the following questions should be answered, and any related information obtained: Why did you choose to engage in the transaction that the IRS deemed “unreportable”? Is it the only use or purpose for which you plan to remit funds? Is there another purpose intended for the remittance? If not, why are you engaging in this transaction? What is the IRS purpose for you participating in the transaction? If you have not yet determined whether the transaction that the IRS declared “unreportable” is intended for a particular use or a particular result, you still have to follow IRS rules regarding the disclosure of reportable transactions. Example: You have determined that the transaction that the tax agency declared “unreportable” is not intended for your use. You are not doing anything illegal, although, the transaction itself is not permitted by IRS rules on tax avoidance. In other words, this is business as usual for you. However, you still need to report this transaction as part of your income on Schedule C. The reportable transaction disclosure should be disclosed on Schedule C, Item 4 (Reportable Transaction Disclosure Statement): Example 2: You have found that the transaction the IRS declared “unreportable” is an ongoing business use which is unrelated to your work. In essence, you are using the money and the IRS's designation has not changed your status with the Tax Agency. You are not required to file a Form 8886 Statement, but you should file it anyway and ask the IRS for a list of the other uses for which you would like to receive payments and report them as well. What if Your Taxpayer Service Client Claimed That You Are Using The Money For Your Personal Use? As described above, a taxpayer does not have to report a reportable transaction unless the IRS has made the determination that the transaction is intended for a specific use or consequence.

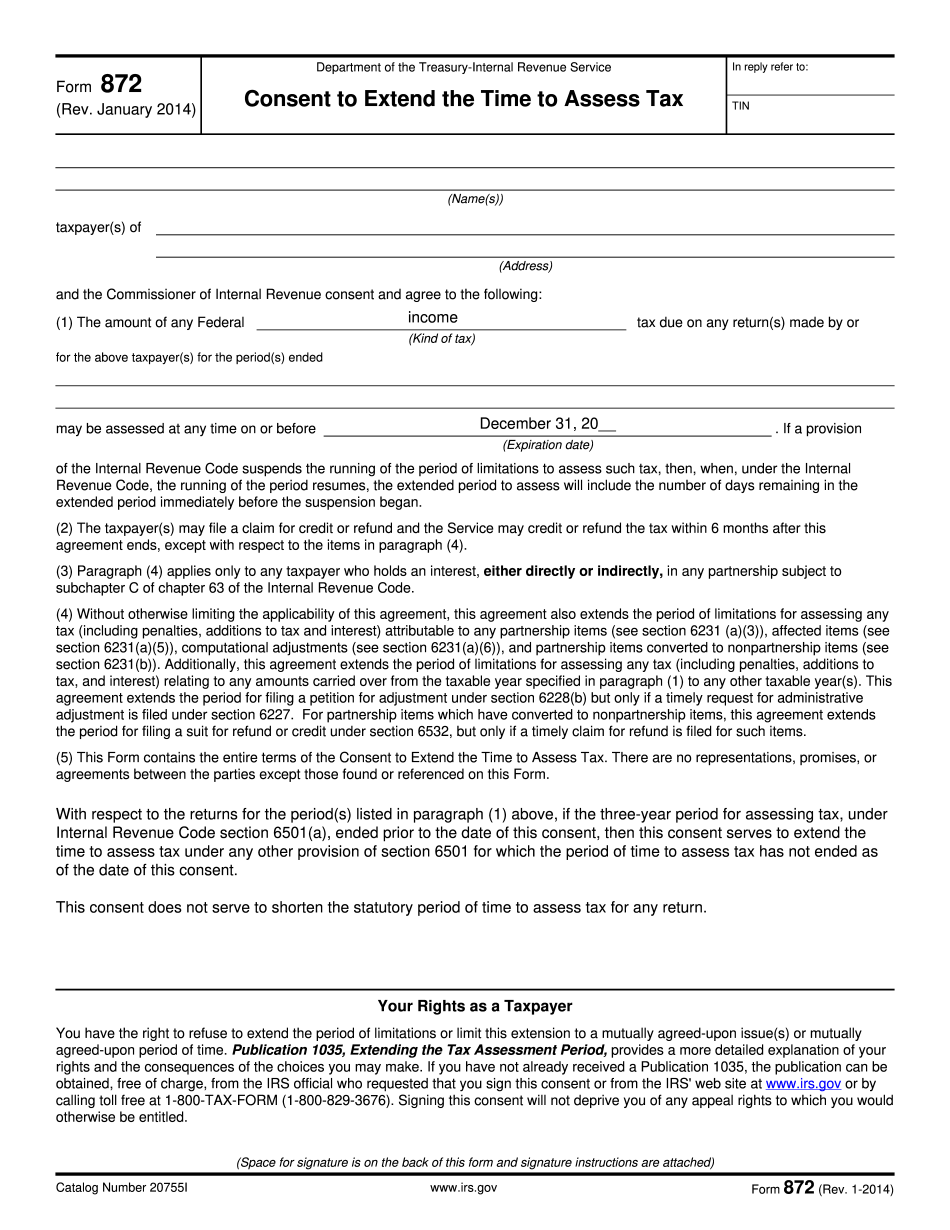

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 872, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 872 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 872 By using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 872 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8886 fill in